where's my unemployment tax refund tool

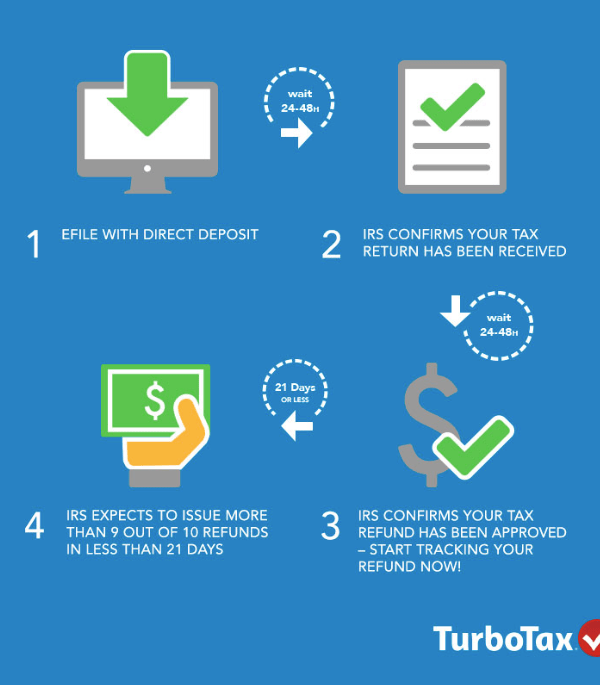

The first way to get clues about your refund is to try the IRS online tracker applications. Unemployment Refund Tracker Unemployment Insurance TaxUni.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

The deadline for filing your ANCHOR benefit application is December 30 2022.

. Income Tax Refund Information. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Your tax return will be processed with the updated requirements.

The Internal Revenue Service doesnt have a separate portal for checking. Did not claim CalEITC. If you filed an amended return you can check the Amended Return Status tool.

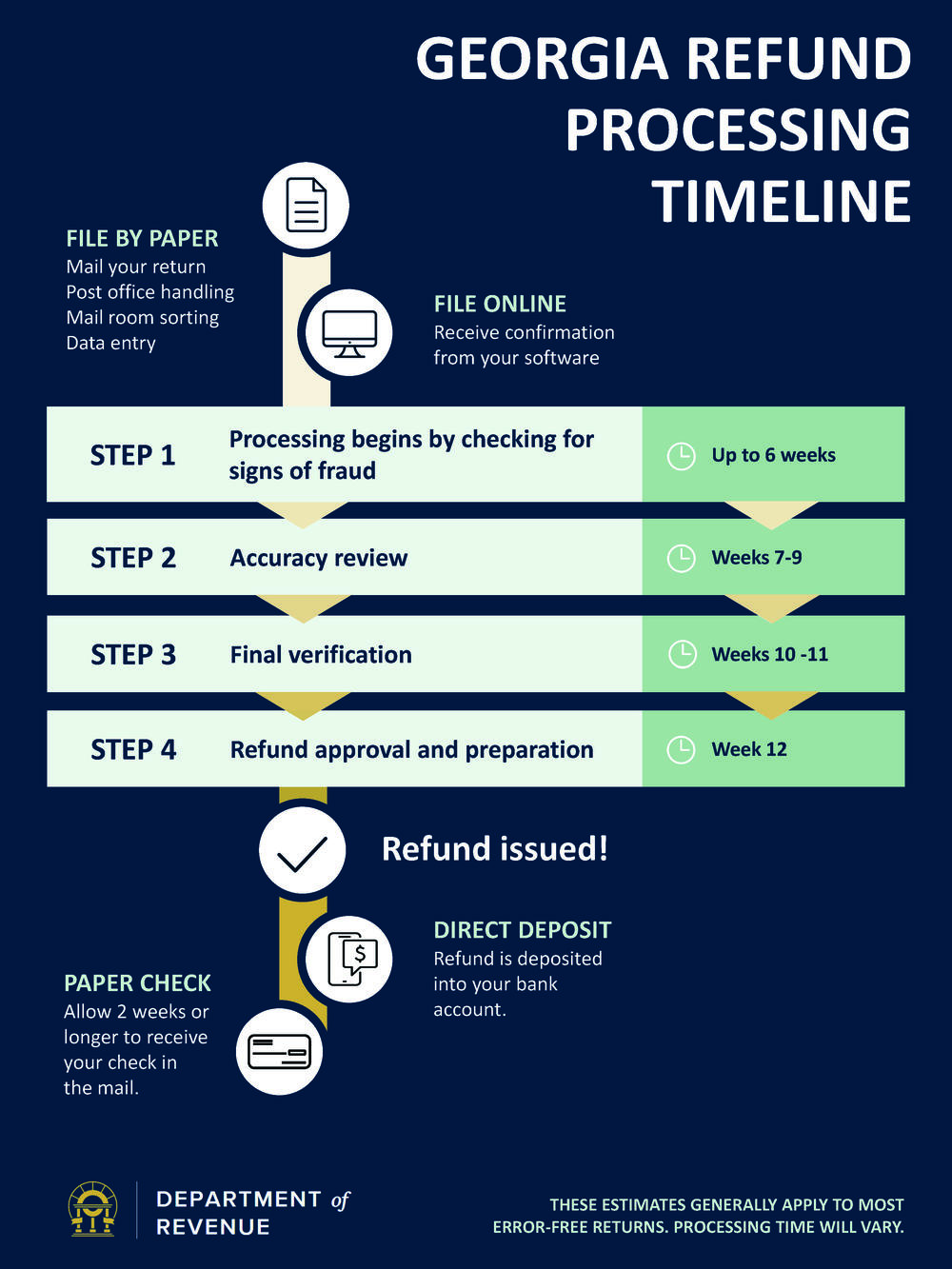

Paper Return Delays If you filed on paper it may take 6 months or more to process your. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha.

Property Tax Relief Programs. View Refund Demand Status. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

Using the IRSs Wheres My Refund feature. Reason For Refund Failure if any Mode of Payment is displayed. Is the IRS sending out unemployment refunds.

Why is my refund taking so long. Visit Wait times to review normal refund and return processing timeframes. Get information about tax refunds and track the status of your e-file or paper tax return.

Go to My Account and click on RefundDemand Status. The IRS has sent 87 million unemployment compensation refunds so far. How To Track Your Refund And Check Your Tax Transcript.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Heres a list of.

Filed your 2020 tax return and. Viewing the details of your IRS account. We will begin paying ANCHOR benefits in the late Spring of 2023.

You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. The Wheres My Refund. Below details would be displayed.

Federal AGI less than 40201 or 50401. GameStop Moderna Pfizer Johnson Johnson AstraZeneca Walgreens Best Buy Novavax SpaceX Tesla. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

You donât need to do anything. Business Economics and Finance.

If State Determines It Overpaid Unemployment Benefits It Can Garnish Your Tax Refund Wsoc Tv

Where S My Refund How To Track Your Tax Refund Statuswhere S My Refund How To Track Your Tax Refund Status Kiplinger

Irs Tax Refund Delays Persist For Months For Some Americans Abc13 Houston

Tax Refund Timeline Here S When To Expect Yours

Unemployment Benefits Tax Issues Uchelp Org

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Where S My Refund Georgia Department Of Revenue

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Where S My Tax Refund The Turbotax Blog

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

State Income Tax Returns And Unemployment Compensation

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

How To Claim Unemployment Benefits H R Block

Where Is My Tax Refund 2021 How Long Does Irs Take To Process Taxes

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Where S My Refund Tax Refund Tracking Guide From Turbotax

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business